Cross-Shareholdings/Business Portfolio

Cross-Shareholdings

Policy on Cross-Shareholdings

We will not have any cross-shareholdings that are not expected to support the Company's sustainable growth and medium- to long-term enhancement of corporate value. The Board of Directors annually examine the validity of cross-shareholdings in terms of the quantitative perspectives, such as whether dividends and rental income are commensurate with cost of capital, and the qualitative perspectives found in business relations.

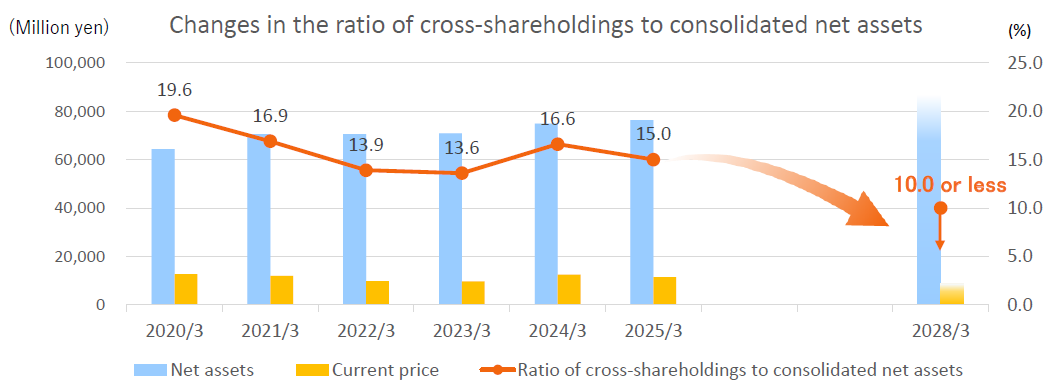

On the other hand, in September 2024 we announced a target to reduce the ratio of cross-shareholdings to consolidated net assets from 16.6% at the end of March 2024 to 10% or less by the final fiscal year of PhaseⅠ(through the FYE March 2028). Going forward, we will proceed with the sale of them to a certain extent in order to achieve its targets based on the results of the examination of the validity of cross-shareholdings at the Board of Directors meeting. As of the end of March 2025, we held cross-shareholdings in 24 listed stocks. We have divested all shares of eight listed stocks and also sold part of the shares of three listed stocks we had owned as part of our cross-shareholdings policy, since 2015 when the Corporate Governance Code was enacted. The total amount of sales during this period was 13.3 billion yen.

Criteria for the exercise of voting rights attached to cross-shareholdings

With regard to the exercise of voting rights pertaining to cross-held shares, we make comprehensive judgements before voting for or against, from the perspective of whether or not the investee company is conducting management that leads to the maintenance and improvement of corporate value over the medium to long term in order to meet the expectations of shareholders and other stakeholders.

In the event of any situation at an investee company, such as a protracted slump in the performance, unstable management, or a scandal involving violation of laws and regulations, we carefully examine the purpose of each proposal and vote against any proposal that would harm our interests as a shareholder, whether it is proposed by the investee company or by its shareholder.

Policy and Status of Review Regarding Business Portfolio

Based on our distinct leasing business, encompassing diverse facilities including office buildings, datacenter buildings, WINS buildings (off-track betting parlors), commercial buildings, logistics warehouses, and other properties, we aim for sustainable growth from a medium- to long-term perspective. New investments are made with a focus on regional diversification and location in an effort to minimize the risk of loss in the event of economic fluctuations and disasters. Furthermore, we work to prevent profitability decline such as by reshuffling assets and investing to increase their value.

Under our current business strategies, we place a high priority on maximizing cash flows generated by our business in our efforts to enhance corporate value. We also recognize the importance of achieving returns that exceed capital costs on a profit basis, and the Board of Directors annually examines our business portfolio. Specifically, policies for continuous property ownership, rebuilding, and sales are individually examined at the Board of Directors' Meeting from both a quantitative point of view, such as comparison of capital cost and profitability and investment recovery period, and a qualitative point of view, such as compatibility with investment policy in the business plan and growth potential of the area where the property is located.

Based also on the result of the portfolio examination, we recognize that maximizing profit through revolving assets and improving capital efficiency are necessary to continue to achieve returns that exceed capital costs over the medium- to long-term. In the newly formulated Long-Term Business Plan, we aim to improve capital efficiency through the engagement in revolving-type investment business in addition to the real estate leasing business.