Risk Management

Risk Management

Basic Concept

For risk management, the Company is committed to realizing business policies and taking measures to eliminate as much as possible every risk that may occur in the course of its corporate activities. It aims to ensure the safety and benefit of all stakeholders and aims for a swift response and recovery at times of emergency.

Promotional Framework of Risk Management

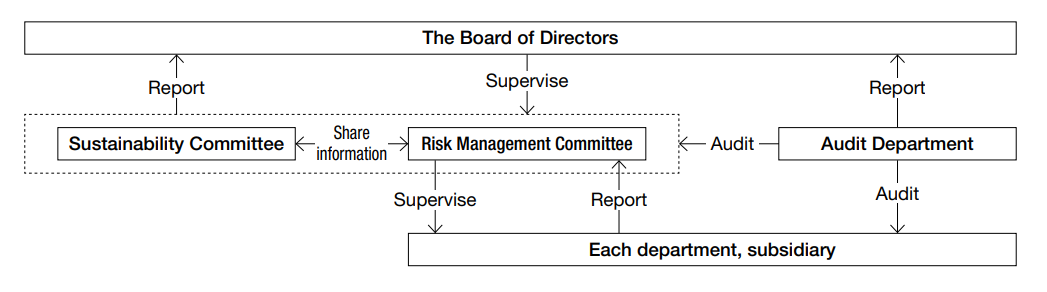

The Company established its fundamental policies on risk management measures and responses towards risks surrounding its business in the Risk Management Regulations. Also, the Risk Management Committee was established as a company-wide organization under the direct control of the President to conduct risk management on a company-wide basis, based on these regulations.

The committee takes charge of matters including integrated risk management, compilation of response policies, and maintenance and updating of the BCP. It convenes regularly and reports on its activities to the President, as well as the Management Meeting and the Board of Directors if necessary. The Board of Directors continuously monitors the effectiveness of the risk management process.

In addition, the process for identifying, evaluating, and managing risks related to sustainability issues is shared with the Sustainability Committee to integrate the risk management system on a company-wide basis.

Protection of Personal Information

The Company acquires personal information through legal and fair means, and utilizes it only to the extent necessary for its operations, such as business activities, exercise of shareholder rights, and performance of obligations. Personal information obtained is managed strictly and safely, in accordance with regulations stipulated by the Company. We take the necessary and rational measures against unauthorized access from outside and other frauds including leakage, loss, or fabrication of personal information. In case of entrusting personal information to external parties, we strictly supervise and manage the handling of personal information by such trustees.