Management Policy

Corporate Governance

Basic Concept

We believe in the importance of improving management efficiency and integrity through establishing a transparent and fair management organization, speeding up the decision-making for important matters on the management, and strengthening the supervisory function of business execution, all of which contribute to improving corporate value.

We are well aware that it is the duty of the Company's directors and employees to put these ideas into practice, as well as complying with all laws and regulations and maintaining discipline, with consideration towards environmental and social issues to conduct a fair, transparent and appropriate business in an atmosphere of free competition. In this way, we show all stakeholders, including our shareholders, customers, business partners, employees, and local communities, that we value the trust that they place in us.

Our Company's officers and employees are small in number, allowing for uncomplicated information gathering and operations management when compared to a large-scale corporation with many staff members. Our corporate organization reflects this feature. We also appropriately arrange our human resources and strive to maintain a sense of balance between each department and committee to fully exert the functions of our organization.

Corporate Governance Report_2025/3/28 [PDF:766KB]

Corporate Governance Structure

Summary of Boards, Meetings, and Committees

| Name | Chairperson | Summary | Number of meetings held (FYE March 2024) |

|---|---|---|---|

|

Board of Directors |

Chairman |

As a general rule, the board holds a meeting once a month to determine important matters on the management and supervise the status of execution of duties. |

11 times |

|

Audit & Supervisory Board |

Audit & Supervisory Board Member (Standing) |

The board audits the Directors' execution of duties and the Company's internal control system, and receives reports from the Independent Accounting Auditor on matters including the quarterly financial results and the year-end audit report. |

12 times |

|

Management Meeting |

President |

The standing officers and general managers in charge of each department attend this meeting to report and review the status and plans of such operation under the basic policy determined by the Board of Directors. |

11 times |

|

Nomination and Remuneration Committee |

Outside Director |

The committee deliberates on personnel matters, including the election and dismissal of the management team. Matters such as compensation for the management team are also deliberated. The chairperson and the majority of the committee members are Independent Outside Directors. |

5 times |

|

Sustainability Committee |

President |

The committee, which is chaired by the President, consists of members of the Sustainability Promotion Group and several members selected from various departments. It convenes regularly and reports on its activities to the Management Meeting and the Board of Directors if necessary. |

5 times |

|

Compliance Committee |

Executive Officer in Charge |

The committee, which is an organization under the direct control of the President, consists of a chairperson and several members selected from various departments. It convenes regularly and reports on its activities to the President, as well as the Management Meeting and the Board of Directors if necessary. |

4 times |

|

Risk Management Committee |

Executive Officer in Charge |

The committee, which is an organization under the direct control of the President, consists of a chairperson and several members selected from various departments. It convenes regularly and reports on its activities to the President, as well as the Management Meeting and the Board of Directors if necessary. |

5 times |

Appointment Process for Directors and Audit & Supervisory Board Members

The President prepares a list of candidates for Directors, and the Board of Directors deliberate and make decisions in light of reports on the results of deliberations in the Nomination and Remuneration Committee.

The President prepares a list of candidates for Audit & Supervisory Board Members and gains the consent of the Audit & Supervisory Board in accordance with the provisions of the Companies Act, after which the Board of Directors deliberates and makes decisions.

Appointment or dismissal of the Chairman and the President will be deliberated and decided at the Board of Directors based on the deliberations in the Nomination and Remuneration Committee. With regard to the dismissal of the Chairman or the President, if deemed necessary by the Nomination and Remuneration Committee, the Nomination and Remuneration Committee may exclude Internal Directors from its composition and report to the Board of Directors after seeking opinions of Outside Directors and Outside Audit & Supervisory Board Members.

Members of the Boards (skill matrix and meeting attendance)

| Name | Nomination and Remuneration Committee | Gender | Term of office | Expertise ( ◎ A field for which Outside Officers are particularly expected) |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate Management | Finance & Accounting | Legal & Risk Management |

Knowledge of real estate businesses |

Constructionn | Technology & Energy | |||||||

|

Board of Directors |

Koichi Minami |

Standing |

● |

Male |

8 years |

● |

● |

● |

● |

|||

|

Tsuneo Wakabayashi |

Standing |

● |

Male |

3 years |

● |

● |

● |

● |

||||

|

Yoshikazu Asakusa |

Standing |

Male |

ー |

● |

● |

● |

||||||

|

Takashi Yoshida |

Outside |

Independent |

● |

Male |

7 years |

◎ |

● |

|||||

|

Masao Nomura |

Outside |

Independent |

● |

Male |

5 years |

◎ |

● |

● |

◎ |

|||

|

Chiho Takeda |

Outside |

Independent |

● |

Female |

2 years |

◎ |

||||||

|

Atushi Miyanoya |

Outside |

Independent |

● |

Male |

ー |

● |

● |

◎ | ||||

|

Audit & Supervisory Board |

Shigeru Nishida |

Standing |

Male |

5 years |

● |

● |

||||||

|

Hideharu Nagasawa |

Outside |

Independent |

Male |

3 years |

◎ |

● |

● |

◎ |

||||

|

Hideyuki Kamijo |

Outside |

Independent |

Male |

2 years |

● |

◎ |

● |

◎ |

||||

(Note)

- The above table does not present a copmlete list of the expertise and experience possessed by each Officer.

- The Director, Ms. Chiho Takeda was in office for three years as Outside Audit & Supervisory Board Member of the Company before taking office as Director.

- The Audit & Supervisory Board Member, Mr. Shigeru Nishida was in office for four years as Director of the Company before taking office as Audit & Supervisory Board Member.

Independence Criteria for Independent Outside Officers

The Company has formulated the following criteria regarding the independence of outside officers, in order to ensure objectivity and transparency in the corporate governance of the Company. If outside officers do not fall under any of the following items, it is judged that they are sufficiently independent from the Company.

| 1 |

A person who is a principal business partner (*1) of the Company or its business executor (*2) |

|---|---|

| 2 |

A person for whom the Company is a principal business partner or its business executor |

| 3 |

A principal shareholder (*3) of the Company (If this is a corporation, association, or any other organization, this refers to a person belonging to such organization.) |

| 4 |

A business executor of a corporation of which the Company is a principal shareholder |

| 5 |

A person who belongs to an auditing firm that serve as the Company's Independent Accounting Auditor |

| 6 |

A consultant, accounting expert, or legal expert who receives money or other assets exceeding 10 million yen annually from the Company in addition to officer remuneration |

| 7 |

A person who receives donations exceeding 10 million yen annually from the Company |

| 8 |

A person who belongs to a company with whom the Company has a relationship for the mutual appointment of Officers |

| 9 |

A person whose spouse or relative within the second degree of kinship falls under any of the above items 1 through 8 |

| 10 |

A person who fell under any of the above items 1 through 8 within the past three years |

| 11 |

A person who has been in office for a total of more than 8 years as an outside officer |

| 12 |

In addition to the preceding items, a person who may have a conflict of interest with general shareholders, and who is reasonably judged to be unable to perform his or her duties as an independent outside officer |

(Notes)

- "A principal business partner" refers to any of the followings:

- A person who has transactions with the Company, and the annual transaction amount is 2% or more of the consolidated net sales of either the Company or said person; or

- A financial institution from which the Company makes loans, and the outstanding loans from such institution is 2% or more of the Company's total consolidated assets.

- A "business executor" refers to an executive director, corporate officer or executive officer.

- A "principal shareholder" refers to a shareholder who holds 10% or more of the Company's voting rights in his or her own or another name as of the end of the most recent fiscal year.

Activity Status of Nomination and Remuneration Committee

With an aim to ensure objectivity and transparency in matters related to the personnel and remuneration of the management team, we have established a Nomination and Remuneration Committee. The majority of the committee members, including the chairperson, are Independent Outside Directors. The Nomination and Remuneration Committee deliberates on the following matters in advance of the Board of Directors, and reports the results of these deliberations to the Board of Directors.

The Board of Directors makes final decisions on matters deliberated by the Nomination and Remuneration Committee, but we believe that independence and authority of the committee are fully secured because the majority members of the Board of Directors are Independent Outside Directors concurrently serving as the Nomination and Remuneration Committee members.

1. Personnel matters for management executives

- Proposals for the Shareholders' Meeting regarding the appointment of candidate Directors

and dismissal of Directors - Establishment, revision, or abolishment of basic policies, rules, procedures, etc., regarding

the appointment of candidate Directors - Appointment and dismissal of the President and the Chairman

- Succession of the President and Chief Executive Officer

- Appointment and dismissal of Executive Officers

- Other matters recognized as necessary by the Nomination and Remuneration Committee

2. Matters concerning remuneration of management executives

- Details of remuneration of individual Directors and Executive Officers

- Establishment, revision, or abolishment of basic policies, rules, procedures, etc., regarding

the remuneration of Directors and Executive Officers - Other matters recognized as necessary by the Nomination and Remuneration Committee

| Name of the committee |

Total committee members |

Chairperson |

Number of meetings held (FYE March 2024) |

||

|---|---|---|---|---|---|

|

Internal Directors |

Outside Directors |

||||

| Nomination and Remuneration Committee |

6 persons |

2 persons |

4 persons |

Outside Director |

5 times |

Succession Planning

The Nomination and Remuneration Committee believes that members of the top management of the Company need to possess the six qualities presented below in order to execute the Long-Term Business Plan and enhance corporate value, in addition to the basic qualities of "A person trusted by others," "A person capable to seek innovation and efficiency," and "A person with a high level of expertise," which are derived from the Company's corporate philosophy.

Succession planning of top management is an important management issue. At a time of great change in the environment surrounding the Company when it is transforming its structure away from that of a company specializing in the leasing industry, the importance of the Company's top management and its succession plan is increasing. We will continue discussing and examining the matter at the Nomination and Remuneration Committee.

| Qualities required of top management |

|---|

|

Comprehensive experience and capabilities related to overall management |

|

Leadership |

|

Knowledge of the real estate industry |

|

Empathy with employees |

|

Ability to respond to changes in the market environment, determination, and courage |

|

Human networks in the business community |

Remuneration to Officers

Remuneration paid to officers in the fiscal year ended March 2024

| Classification | Number of members paid | Subtotal by type of remureration | ||||

|---|---|---|---|---|---|---|

| Base remuneration | Performance-linked remuneration | Non-monetary remuneration | Total amount of remuneration | |||

|

Directors |

7 persons |

123,870 thousand yen |

15,764 thousand yen |

43,729 thousand yen |

183,363 thousand yen |

|

|

Outside Directors |

4 persons |

33,600 thousand yen |

- |

- |

33,600 thousand yen |

|

|

Audit & Supervisory Board Members |

3 persons |

40,800 thousand yen |

- |

- |

40,800 thousand yen |

|

|

Outside Audit & Supervisory Board Members |

2 persons |

15,600 thousand yen |

- |

- |

15,600 thousand yen |

|

(Notes)

- In addition to the above, employee salaries of 18,607 thousand yen are paid to Directors who concurrently serve as employees.

- The Company pays bonuses to Directors (excluding Outside Directors and Non-Executive Directors) as performance-linked remuneration. The details of such performance-linked remuneration are as described in "Policy for determining Directors' remuneration."

- The Company grants restricted stock remuneration to directors (excluding Outside Directors) as non-monetary remuneration. The details of such stock-based remuneration are as described in "Policy for determining Directors' remuneration."

- In determining the details of remuneration to individual Directors for the fiscal year, the Nomination and Remuneration Committee, whose majority is composed of Independent Outside Directors, conducts multifaceted examinations of remuneration proposals, including their consistency with the determination policy. The Board of Directors honors the Committee's recommendations, in principle, and thus judges that they are in line with the determination policy.

Policy for determining Directors' remuneration

The Company determines remuneration to Directors in line with the shareholders' interests so that it will serve as an appropriate incentive leading to a sustainable increase in the shareholder value. As a basic policy, when determining remuneration to individual Directors, the Company aims to secure appropriate levels corresponding to the degree of their responsibilities.

As for the determination policy for remuneration, the Nomination and Remuneration Committee, whose majority is composed of Independent Outside Directors, is consulted, and the Board of Directors resolves it, honoring the Committee's recommendations.

| Remuneration system |

Executive Directors |

It consists of base remuneration as fixed remuneration, bonuses as performance-linked remuneration, and restricted stock as non-monetary remuneration in line with the shareholders' interest. |

|||||||

|---|---|---|---|---|---|---|---|---|---|

|

Chairman of the Board |

It consists of the base remuneration as fixed remuneration and restricted stock as non-monetary remuneration as the Chairman will perform the expected role as a chairperson of the Board of Directors for increasing the shareholders' value in the medium- to long-term, despite being not directly involved in business execution. |

||||||||

|

Outside Directors |

The Company will pay only the base remuneration to Outside Directors in consideration of their duties. |

||||||||

|

Remuneration composition |

|||||||||

| Remuneration amount |

Base remuneration |

It is provided as fixed remuneration monthly. The amount is determined based on the Company's performance, individual's duties, abilities, and the degree of contribution to the Company's sustainable growth in a comprehensive manner. |

|||||||

|

Bonuses |

It is paid as a bonus at a certain time each year. In the long-term management plan starting with the the fiscal year ended March 31, 2024, we have made diversification of investment methods part of our business strategy and promotion of ESG-conscious sustainability strategies an important measure, and therefore, from the fiscal year ended March 31, 2024, the achievement level of "business profit before depreciation and amortization", "sustainability initiatives" and "ROE" will be used as indicators for calculating performance-linked compensation. The calculation is based on a comprehensive consideration of those as an indicator of the Company's progress in continuously increasing its corporate value and expanding its corporate scale and creating a new earnings model through portfolio expansion. Target performance indicators and their values will be reviewed from time to time based on the consultation and report of the Nomination and Compensation Committee so that they are consistent with the long-term management plan. (Reference) Actual business profit before depreciation and amortization and the target for the final fiscal year of the Long-Term Business Plan (million yen)

|

||||||||

|

Restricted stock |

It is granted in the form of restricted stock linked to the shareholder value. The number of shares given at a certain time each year will be calculated based on the duties and abilities of Chairman and Executive Directors, along with their contributions to the Company's sustainable growth in a comprehensive manner. |

||||||||

| Determining method |

As for the amounts of remuneration, the President will prepare a remuneration plan, consult with the Nomination and Remuneration Committee, and the Board of Directors will deliberate and make decisions on it, honoring the Committee's recommendations. Regarding restricted stock remuneration, the numbers of shares to be allotted to individual Directors will be resolved by the Board of Directors based on the recommendations of the Nomination and Remuneration Committee. |

||||||||

Cross-Shareholdings

Policy on Cross-Shareholdings

We will not have any cross-shareholdings that are not expected to support the Company's sustainable growth and medium to long term enhancement of corporate value. Every year, the Board of Directors will examine the validity of cross-shareholdings in terms of the quantitative

perspectives, such as whether dividends and rental income are commensurate with cost of capital, and the qualitative perspectives found in business relations.

On the other hand, we announced a target to reduce the ratio of cross-shareholdings to net assets from 16.6% at the end of March 2024 to 10% or less by Phase (through the FYE March 2028). Going forward, we will proceed with the sale of them to a certain extent in order to

achieve its targets based on the results of the examination of the validity of cross-shareholdings at the Board of Directors meeting.

As of March 31, 2024, we own 25 listed stocks and seven unlisted stocks. We have divested all shares of eight stocks we had owned as part of our cross-shareholdings policy, also sold part of the shares of three listed stocks. since 2015 when the corporate governance code was

enacted. The total amount of sales during this period was 11.7 billion yen.

Trend in cross-shareholdings of listed companies

|

FYE Mar.31, 2020 |

FYE Mar.31, 2021 |

FYE Mar.31, 2022 |

FYE Mar.31, 2023 |

FYE Mar.31, 2024 |

|||

|---|---|---|---|---|---|---|---|

|

Amount recorded on year-end balance sheet (million yen) |

12,629 |

11,910 |

9,775 |

9,607 |

12,449 |

||

|

Amount sold during the fiscal year |

784 |

6,530 |

2,468 |

1,087 |

297 |

||

|

Ratio of cross-held shares to net assets (%) |

19.7 |

17.0 |

13.9 |

13.6 |

16.6 |

||

|

Number of listed stocks cross-held |

Listed |

27 |

27 |

26 |

26 |

25 |

|

|

Unlisted |

8 |

8 |

8 |

7 |

7 |

||

Criteria for the exercise of voting rights attached to cross-shareholdings

With regard to the exercise of voting rights pertaining to cross-held shares, we make comprehensive judgements before voting for or against, from the perspective of whether or not the investee company is conducting management that leads to the maintenance and improvement of corporate value over the medium to long term in order to meet the expectations of shareholders and other stakeholders.

In the event of any situation at an investee company, such as a protracted slump in the performance, unstable management, or a scandal involving violation of laws and regulations, we carefully examine the purpose of each proposal and vote against any proposal that would harm our interests as a shareholder, whether it is proposed by the investee company or by its shareholder.

Policy and Status of Review Regarding Business Portfolio

Based on our distinct leasing business, encompassing diverse facilities including office buildings, datacenter buildings, WINS buildings (off-track betting parlors), commercial buildings, logistics warehouses, and other properties, we aim for sustainable growth from a medium- to long-term perspective. New investments are made with a focus on regional diversification and location in an effort to minimize the risk of loss in the event of economic fluctuations and disasters. Furthermore, we work to prevent profitability decline such as by reshuffling assets and investing to increase their value.

Under our current business strategies, we place a high priority on maximizing cash flows generated by our business in our efforts to enhance corporate value. We also recognize the importance of achieving returns that exceed capital costs on a profit basis, and the Board of Directors annually examines our business portfolio. Specifically, policies for continuous property ownership, rebuilding, and sales are individually examined at the Board of Directors' Meeting from both a quantitative point of view, such as comparison of capital cost and profitability and investment recovery period, and a qualitative point of view, such as compatibility with investment policy in the business plan and growth potential of the area where the property is located.

Based also on the result of the portfolio examination, we recognize that maximizing profit through revolving assets and improving capital efficiency are necessary to continue to achieve returns that exceed capital costs over the medium- to long-term. In the newly formulated Long-Term Business Plan, we aim to improve capital efficiency through the engagement in revolving-type investment business in addition to the real estate leasing business.

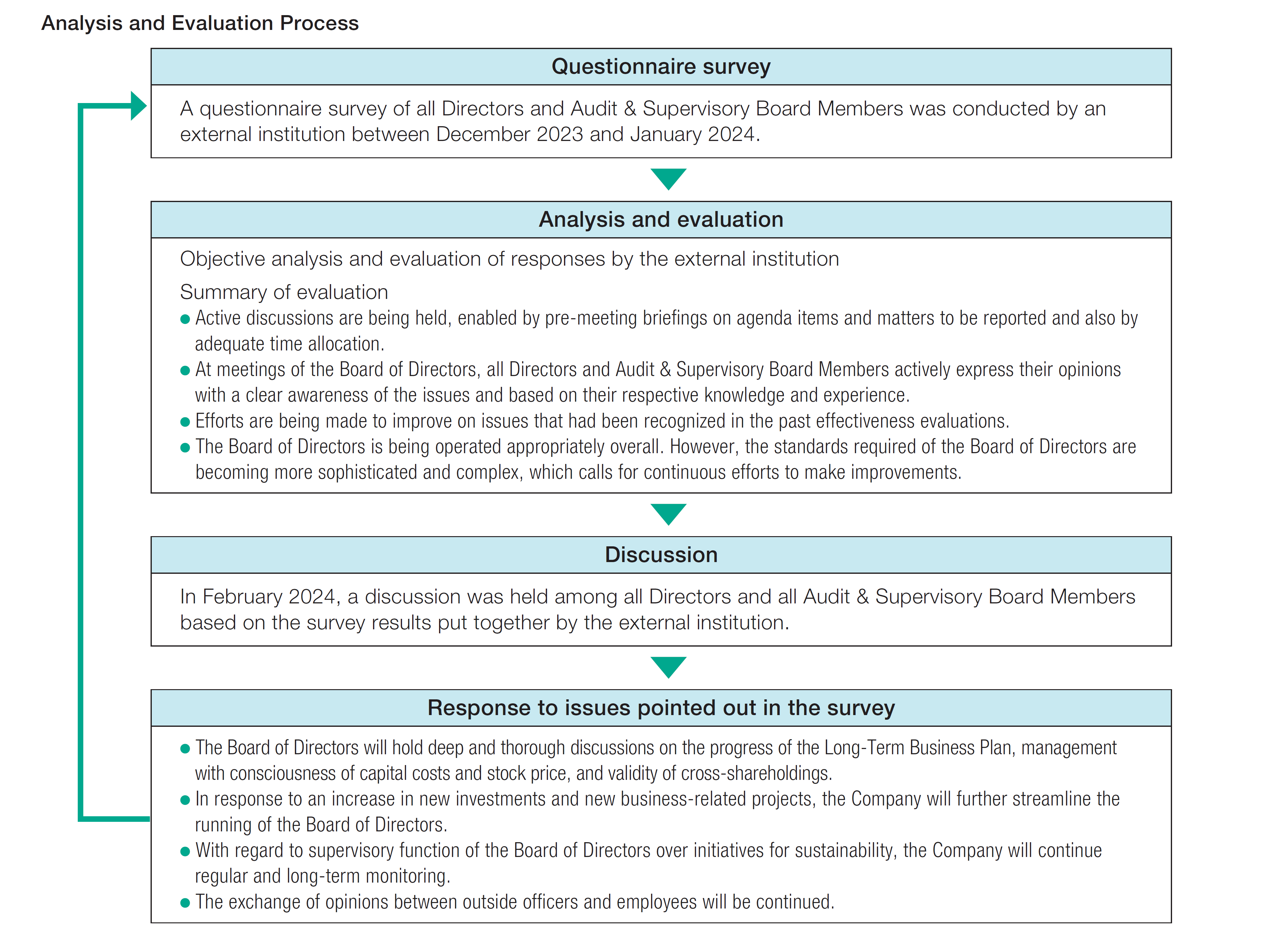

Analysis and Evaluation of the Effectiveness of the Board of Directors

With the purpose of ensuring effectiveness in the Board of Directors and enhancing the corporate value, self-assessments have been carried out by the Board of Directors since 2017. In 2024, the Company followed the process shown below to analyze and evaluate the effectiveness of the board, and confirmed that the Board of Directors was being operated appropriately overall.

We will continue to engage in enhancing the function of the Board of Directors by implementing periodic analysis and evaluation of the board's effectiveness.

Progress on the issues pointed out in the 2023 survey

| Issues pointed out in the past | Details of progress on the issues |

|---|---|

|

Providing opportunities for exchanging opinions between outside officers and executive officers other than at the Board of Directors' Meetings |

• Provided opportunities for Outside Directors and |

|

Strengthening the supervisory function of the Board concerning initiatives for sustainability |

• Held sustainability training sessions for officers |

Main agenda items of the Board of Directors (FYE March 2024)

| Matters resolved | Matters reported |

|---|---|

|

• Formulation of Long-Term Business Plan |

• Evaluation of the effectiveness of the Board |

|

• New investments |

• Progress with the Long-Term Business Plan |

|

• Important personnel matters (directors, |

• Reports on business execution by various |

|

• Examination of validity of cross- |

• Reports on activities of various committees |

|

• Examination of business portfolio |

• Reports on the implementation of internal |

|

• Settlement of accounts |

|

|

• Formulation of Human Rights Policy |

|

|

• Formulation of sustainability-related policies |

Policy on constructive dialogue with shareholders and investoers

Executive Officers responsible for administration are in charge of dialogue between the Company and shareholders/investors. Each department within the Company coordinates with the officers accordingly in providing necessary information to promote constructive engagement between them.

In terms of providing opportunities for dialogue, we have established briefing sessions with the presence of the President or Executive Officers responsible for administration and individual meetings, and issue an integrated report and other IR materials and disclose information on the corporate website as well to help our shareholders and investors to understand our management strategy and business environment better.

The opinions and requests received from shareholders and investors through dialogue are reported to the Board of Directors on a quarterly basis, and dialogue records are always shared among Directors and Audit & Supervisory Board Members. These opinions and requests are valued to further strengthen our dialogue, and relayed to the management and related departments to use for active review of our business strategies.

During the silent period before announcing our financial results, we restrict dialogue with our shareholders and keep the insider information strictly confidential. Information deemed to be a material fact is managed centrally by the Executive Officers responsible for administration to prevent any leaks. We disclose immediately if the information is determined to correspond to information requiring disclosure as well.

Number of dialogues with investors held in the fiscal year ended March 2024

| Target | Number of dialogues held (cumulative total) |

|---|---|

|

Coverage analysts |

10 |

|

Domestic institutional investors |

8 |

|

Foreign institutional investors |

14 |

|

Individual investors |

6 |

|

Total |

38 |

Main topics and concerns of the dialogue

| Topics and concerns (FYE March 2024) |

|---|

|

• Timeline of the Long-Term Business Plan |

|

• Progress in new businesses and recruitment of personnel |

|

• Disclosure of capital costs |

|

• Improvement of stock price and capital efficiency |

|

• Status of reducing cross-shareholdings |

|

• Strengthening of link between Directors' remuneration and shareholder value |

Status of Response

Based on the opinions and suggestions from shareholders and investors, and after discussions at the Board of Directors, we have implemented the following measures.

| Measures implemented |

|---|

|

• Launched new businesses ahead of schedule |

|

• Disclosed capital costs |

|

• Added ROE achievement level to the KPIs of performance-linked remuneration for Directors |

|

• Promoted recruitment |

|

• Formulated a plan for reducing cross-shareholdings |

Training for Directors and Audit & Supervisory Board Members

In order to optimize our business strategies through timely and appropriate decision-making by the Board of Directors, the Company provides Directors and Audit & Supervisory Board Members with opportunities for training related to themes according to the business environment and inspections of the Company's properties. Especially for newly appointed Directors and Audit & Supervisory Board Members, the Company provides trainings on issues such as their legal authority and obligations, also utilizing outside institutions. Whether these opportunities are being appropriately provided is also verified during the annual evaluation of the effectiveness of the Board of Directors.

In FYE March 2024, we held a training session on the theme of sustainability (business and human rights).

At a training session for officers

At a training session for officers

Status of Coordination between Audit & Supervisory Board Members, Independent Accounting Auditors, and Internal Auditing Division

Audit & Supervisory Board Members regularly receive audit reports from an Independent Accounting Auditor. In addition, Audit & Supervisory Board Members share information with the Independent Accounting Auditor on changes in accounting standards and policies and other matters that may have a significant impact on the Company's business results by holding meetings as necessary.

Audit & Supervisory Board Members share information with the internal auditing division by holding liaison meetings monthly between the Audit & Supervisory Board Member (Standing) and the Audit Department. In addition, the Audit & Supervisory Board receives quarterly internal audit reports directly from the Head of the Audit Department.

In this manner, we strive to improve the effectiveness of audits through close coordination between the Audit & Supervisory Board Members, the Independent Accounting Auditor, and the internal auditing division.

Risk Management

Basic Concept

For risk management, the Company is committed to realizing business policies and taking measures to eliminate as much as possible every risk that may occur in the course of its corporate activities. It aims to ensure the safety and benefit of all stakeholders and aims for a swift response and recovery at times of emergency.

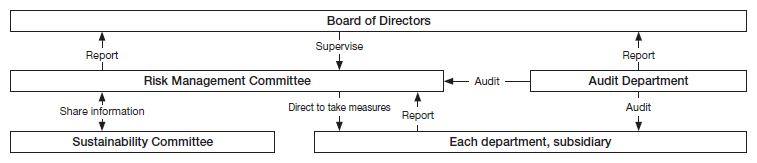

Promotional Framework of Risk Management

The Company established its fundamental policies on risk management measures and responses towards risks surrounding its business in the Risk Management Regulations. Also, the Risk Management Committee was established as a company-wide organization under the direct control of the President to conduct risk management on a company-wide basis, based on these regulations.

The committee takes charge of matters including integrated risk management, compilation of response policies, and maintenance and updating of the BCP. It convenes regularly and reports on its activities to the President, as well as the Management Meeting and the Board of Directors if necessary.

In addition, the process for identifying, evaluating, and managing risks related to sustainability issues is shared with the Sustainability Committee to integrate the risk management system on a company-wide basis.

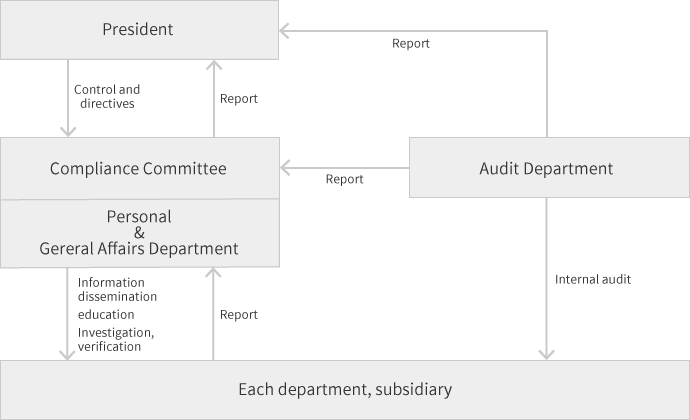

Compliance Committee

We have established a company-wide Compliance Committee under the direct control of the President to comply with laws, regulations, and other social norms, as well as in-house standards, such as our internal rules and to maintain and enhance a sound corporate culture. The committee convenes regularly and reports on its activities to the President, as well as the Management Meeting and the Board of Directors if necessary.

The committee takes charge of formulating the Behavioral Standards to ensure compliance, assessing the implementation status of compliance measures, and devising recurrence prevention measures against compliance violations. In addition, compliance education and training are provided to employees at all levels through in-house study sessions and other learning opportunities.

Compliance Structure

Compliance with Laws, Regulations, etc., Thorough Practice of Fair Trade and Competition, Prevention of Corruption, and Elimination of Dealings with Antisocial Forces

To prevent misconducts in its business operation, the Company has established the Code of Conduct and Behavioral Standards.

| Excerpts from the Code of Conduct and Behavioral Standards |

|---|

|

1.We will always adhere strictly to all laws, ordinances and regulations including those |

|

2.In all transactions, we will conduct business in a fair and impartial manner based on |

|

3.We will maintain healthy and normal relationships with political and administrative |

|

4.We will take a firm stand against anti-social forces and organizations and never offer |

Other Initiatives:

Protection of personal information, environmental protection, prohibition of insider trading, respect for human rights, and appropriate handling of information

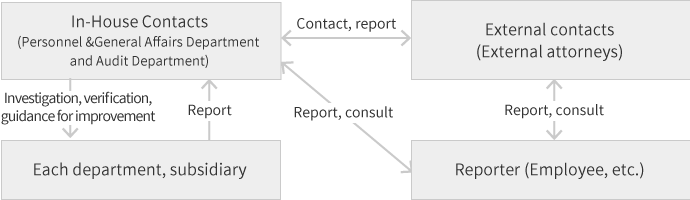

In-House Reporting System

The Company has established an In-House Reporting System to receive reports from employees and provide consultations on compliance violations. In addition to the in-house contact point, external attorneys have been designated as a contact point, and appropriate measures are taken to prohibit any disadvantageous treatment of individuals who report violations and to ensure that their work environment will not be deteriorated. Moreover, the Board of Directors oversees the status of operation of the system through regular reports by the executive officer in charge to the Board of Directors

Compliance Training

Aiming to increase the compliance awareness of all officers and employees, the Company holds compliance training sessions on a regular basis on such topics as human rights, harassment, insider trading, and information security.

Audit Department

The Audit Department works separately from the Compliance Committee to conduct compliance status audits appropriately. The results of these audits are reported to the President and Compliance Committee, and to the Management Meeting and the Board of Directors if necessary.

Protecting Personal Information

The Company acquires personal information through legal and fair means, and utilizes it only to the extent necessary for its operations, such as business activities, exercise of shareholder rights, and performance of obligations. Personal information obtained is managed strictly and safely, in accordance with regulations stipulated by the Company. We take the necessary and rational measures against unauthorized access from outside and other frauds including leakage, loss, or fabrication of personal information. In case of entrusting personal information to external parties, we strictly supervise and manage the handling of personal information by such trustees.

Measures for major risks

| Classification | Description of the risk | Status of risk response | |

|---|---|---|---|

|

Operating |

Land and |

|

|

|

Regional |

|

|

|

|

Dependence on |

|

|

|

|

Fluctuation in |

|

|

|

|

Disaster |

Natural disasters and |

|

|

|

Spread of |

|

|

|

|

Climate |

Transition |

|

|

|

Physical |

|

|

|

|

Financial |

Fluctuation |

|

|

|

Dependency |

|

|

|

|

Amendments |

|

|

|

|

Compliance |

Violation of laws,regulations,etc. |

|

|

|

Information |

Information |

|

|